Momentum

Momentum: The Confounding Phenomenon

“The Hardest Truths Don’t Have a Why”

Nils Lofgren “Black Books”

In 1993, a seminal study was published in the Journal of Finance by Narasimhan Jegadeesh and Sheridan Titman, which highlighted the outperformance of what appeared to be a fairly simple strategy: buy the winners and sell the losers. The study exposed the phenomenon of momentum in financial markets, a phenomenon that buckled the knees of proponents of Efficient Market Theory. Efficient Market disciples have long asserted that at any moment in time a stock’s price reflects all the relevant information about the company. That theory has become gospel in many circles and has done much to push forward the drive towards passive, index investing. I certainly would never diminish the benefits of passive investing; it has definitely shown improvements versus “random” stock picking. However, employing a systematic, model-based strategy has shown equal value in terms of improved returns and risk reduction. We believe that momentum-based investing is one of those models.

While the 1993 study illustrated the performance benefits of momentum, it failed to explain the reasons behind the phenomenon. Since that study was published, many have attempted to explain the reason for its existence. Across many topics academics and scientists spend a lot of ink and countless hours trying to explain the “why” to behind many challenging issues, all the while practitioners put the information and data to beneficial use. When Quantum theory emerged in physics, nearly 100 years ago, it sparked an academic debate between Nils Bohr and Albert Einstein that lasted decades. Meanwhile, without waiting for a resolution to the debate, the world went on to create lasers, CDs, DVDs, and fiber-optics. Sometimes it’s just best to accept results and design methods to implement them.

At Calibrate Wealth, we time is more valuably spent on data analysis rather than discerning the reasons behind the data. To that end we’ve adopted momentum as a vital part of our portfolio strategy. Below we’ve laid out a couple examples of momentum in practice. These examples represent hypothetical portfolios, and are not meant as a representation of the models we build for our clients. But, we believe that these fairly generic representation give a good illustration of the recorded benefits of momentum based strategies.

Example 1

Asset Class Based Momentum

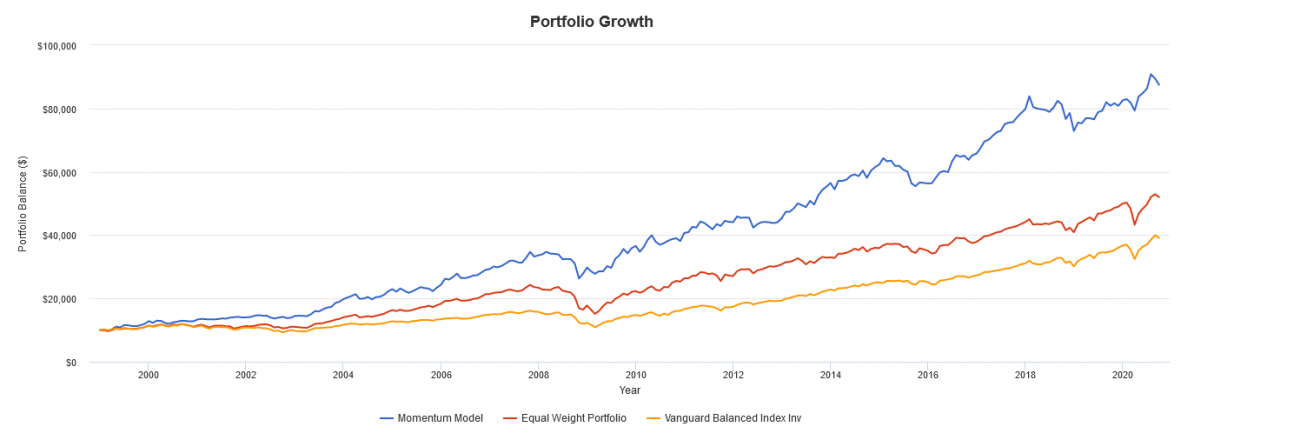

We’ve compiled a multi-asset portfolio consisting of indexed stock investments, government bond investments, US corporate bonds, REITs, and gold. We’ve compared the performance over time of a portfolio with a static, equal weighting to each asset, a more traditional Vanguard Balanced Index Fund, and a portfolio which actively allocates to the best performing assets of the group, while excluding the others. In this example we look back over the past 6 months and select the top 5 best performing assets out 11 options.

Here are the results as we ran them:

The yellow line is the Vanguard Balanced Index Fund, the red line is how the static, equal weighting to the 11 asset portfolio would’ve performed, and the blue line is the performance of the momentum based allocation. Below is a table which quantifies the results:

1999-Present | Initial Balance | Final Balance | Avg Return | Volatility | Max Drawdown | Sharpe Ratio | Stock Market Correlation |

Momentum Model | $10,000 | $87,509 | 10.49% | 10.82% | -24.19% | 0.82 | 0.61 |

Equal Weight Portfolio | $10,000 | $52,012 | 7.88% | 10.83% | -37.71% | 0.59 | 0.88 |

Vanguard Balanced Index | $10,000 | $39,138 | 6.47% | 9.20% | -32.57% | 0.53 | 0.99 |

We see that the momentum model not only provided higher average returns, it also had lower drawdowns and a lower correlation to the US stock market.

Example 2

Individual Stock Momentum

Using some of the work done by Narasimhan Jegadeesh and Sheridan Titman, we find that the same momentum phenomenon that exists across asset classes also is present in individual stocks. The study published in the 1993 Journal of Finance highlighted the benefits of buying the more recent “winning” stocks and selling the more recent “losing” stocks. In their study, Jegadeesh and Titman found that a momentum strategy produced excess returns of 0.5% on a monthly basis versus a simple buy and hold strategy. The study also acknowledged the benefits of momentum-based strategies going back to 1927, when most comprehensive US stock market data begins. When we compiled our own research, which spanned the years 1999-2018, we found that the phenomenon of momentum has not gone away.

In their study, Jegadeesh and Titman, employed a long and short strategy of buying the winners and shorting the losers. Understanding that many clients either are unable to short stocks (IRA’s) or are uncomfortable shorting stocks, we first examined a strategy of simply buying the winners. Next, we followed up with an alternative approach of buying the relative “winners” only if they were absolutely positive over a more recent period (Single Momentum). If a stock was down over a more recent period, but still a relative top performer, we allocated that stock’s portion to a treasury bond allocation for the holding period (Dual Momentum). We limited our universe of stocks to the stocks that were in the S&P 500. To eliminate survival bias we only included stocks that were actually in the index at the time of examination. Here is what we found:

July 1999-May 2018 |

|

|

|

|

|

|

Strategy: Look back 12 months; hold for 3 months | Beginning Balance | Ending Balance | Average Return | Standard Deviation | Sharpe Ratio | Max Drawdown |

Single Momentum | $10,000 | $44,062 | 7.9% | 18.3% | 0.43 | -57.55% |

Dual Momentum | $10,000 | $82,287 | 11.4% | 14.2% | 0.8 | -33.46% |

S&P 500 | $10,000 | $29,437 | 5.7% | 14.5% | 0.39 | -50.78% |

Using the same look back and holding period from the ’93 study in the Journal of Finance, we found returns from a Dual Momentum strategy which produced similar excess returns of 0.5% per month. Furthermore, we can see that even the simple, buy only momentum strategy produced a significant level of outperformance versus the index.

Conclusion

We hope that this has provided insight into the momentum phenomenon, past success doesn’t necessarily imply future success, notably over shorter periods of time. The research on momentum-based strategies is fairly extensive, with many researchers finding that it dates back to the beginning of financial markets. The actual momentum based strategies that we run at Calibrate Wealth differ from the illustrations above. To find out more about employing these strategies contact us for a complete run down of our offerings.

References